Explain the Different Methods of Computing Interest in Account Current

C The rate of interest on deposits made in a Recurring Deposit Account. In this method the following steps are.

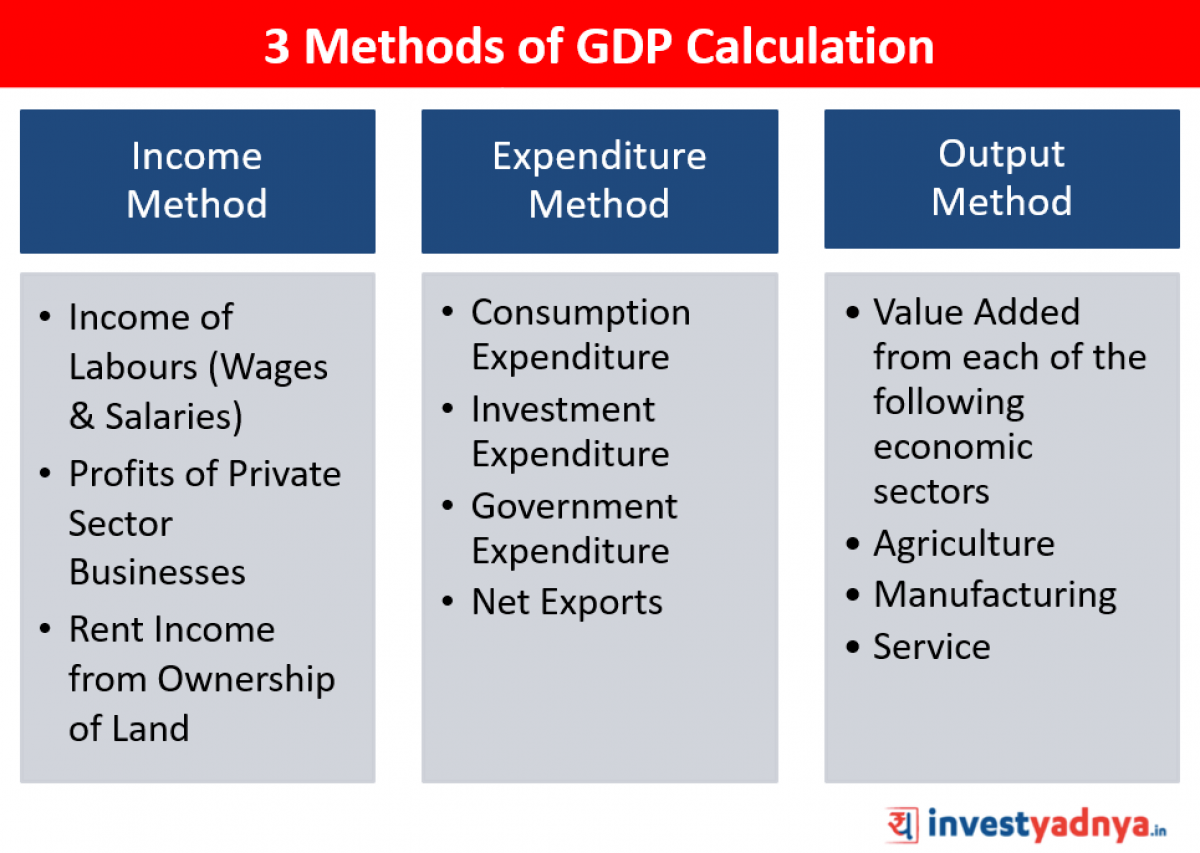

3 Methods Of Gdp Calculation Yadnya Investment Academy

Fixed Deposit Interest Formula Maturity Value A P x 1 rnnt So for the maturity value of Fixed Deposit of Rs100000 fetching interest 87 pa.

. Regular fixed annuities credit interest at a rate that is linked to the T. The most common depreciation methods include. This method is also known as Individual Method.

So the interest earned over 3 years is 10000 x 03 x 3 900. They are usually easier to access but offer a lower interest rate as they are used for day to day business and expenses. It is calculated from the date of drawing till the close of accounting period.

So now if you see the same example we discussed above with the new method of interest calculation the interest will be 4 on 5 lacs Rs 1369 for 25 days from start of month to 25th and on 10000 for next 5 days Rs 5 26th 30th. This method is the reverse of the first two methods. Production units in an economy are classified into primary secondary and tertiary sectors.

For calculating national income- an economy is looked upon from three different angles which are as follows. A trade deficit alone can be enough to create a current account deficit. Traditionally there are two common methods used for calculating interest.

Calculating Depreciation Using the Units of Production Method. How interest is calculated on tiered savings accounts There are two methods banks use to calculate interest on tiered savings accounts. I the 365365 method or Stated Rate Method which utilizes a 365-day year.

The rate of interest in this case will be 15 per. B A fixed amount is required to be deposited in a Fixed Deposit Account every month. Heres the formula for calculating simple interest.

Out of all the ways to calculate finance charges this method results in the lowest finance charge but not very many credit card issuers use it. Non-Resident External Rupee Account. You also need to.

Demand Deposit are types of bank deposits that can be withdrawn on-demand at any time. Fixed deposits generally pays higher interest than savings account. The book value figure is typically viewed in relation to the.

So if you deposited 100 for two years with an interest rate of 3½ you would earn 100 x 035 x 2 or 7. The simple interest formula is I PRT where I is the amount of interest earned P is the amount deposited principal R is the rate of interest and T is the number of years. Interest is computed from the opening date Of the account current to the date of each transaction.

Even though the interest is calculated on daily balance amount it is credited to your account either half- yearly or quarterly based on your banks policy. With this you can earn interest on the deposited amount. Whole Balance Method - The bank pays interest on the whole balance at the highest tier reached.

But it comes with a lock-in period. Interest-crediting methods differ for other types of annuities. Principal x interest rate x n interest To show you how interest is calculated assume someone deposited 10000 in the bank in a money market account earning 3 percent 003 interest for 3 years.

Thus no interest is charged on the opening balance while interest for the whole period will be charged on the closing balance. Account Current with the help of Interest Tables. He then decides to deposit the initial amount of 10000 into the high-interest savings account.

Under this method interest on drawings is calculated on each and every amount of drawing separately. The adjusted balance method starts with the balance at the beginning of the billing cycle and subtracts any payments you made during the billing cycle. Calculation of Interest on Fixed Deposit in case of Pre-mature Withdrawl.

Some banks offer a Sweep-in facility to the customers having a current account with which any amount above the threshold limit will be automatically converted into Fixed Deposit FD. On the basis of this classification value-added method is used to measure national income. Non-Resident Ordinary Rupee Account.

Asset cost - salvage valueestimated units over assets life x actual units made. According to this method we arrange all the transactions in the form of a ledger account. The following different compound interest example gives an understanding of the most common type of situations where the compound interest is calculated and how one can calculate the same.

There are two methods to calculate interest on drawings. Sum of years digits. Apart from Zero-balance Accounts customers will need to keep a minimum balance in Current Account.

This is the amount that must be paid back by the borrower. These three methods of calculating GDP yield the same result because National Product National Income National Expenditure. The formula to calculate interest is.

And ii the 360365 method or Bank Method which utilizes a 360-day year and charges interest for the actual number of days the loan is outstanding. 3 A deficit in goods and services is often large enough to offset any surplus in net income direct transfers and asset income. Now a new method is used to calculate the interest on saving bank account which is very fair.

Trade in goods and services is the largest component of the current account. Partial Balance Method - The bank pays a different interest rate for each tier of the balance. In this method the value of all goods and services produced in different industries during the year is added up.

After 5 years would be Principal Amount P Rs100000 Rate of Interest r 87 0087 Number of Period t 5 years. Given a fixed interest rate of 5 the actual cost of the loan with principal and interest combined is 10500. A Deposits made in savings bank account serve to meet present as well as future needs.

Purchases are not included in the balance. Depreciation expense is used in accounting to allocate the cost of a tangible asset. There are two more columns on both the sides of the account.

Banks calculate compound interest quarterly on fixed deposits. 25000 - 50050000.

Skills C Competitive Programming Infographic Quotes Graphic Computer Science Info Trending Teaching Coding Essay Writing Skills Make An Infographic

This Infographic Describes What Is Cloud Computing What Are Its Benefits What Are The Different Types Etc What Is Cloud Computing Cloud Computing Infographic

No comments for "Explain the Different Methods of Computing Interest in Account Current"

Post a Comment